Understanding the Documents Required for Filing Chapter 7 Bankruptcy in Louisiana

Understanding the Documents Required for Filing Chapter 7 Bankruptcy in Louisiana

Are you a Louisiana resident struggling with overwhelming debt and considering filing for Chapter 7 bankruptcy? It can be a daunting process, but with the right information and guidance, you can navigate through it successfully. At De Leo Law Firm, LLC, we help Louisiana residents with their bankruptcy matters. In this blog post, we will discuss the essential documents required to file for Chapter 7 bankruptcy in Louisiana.

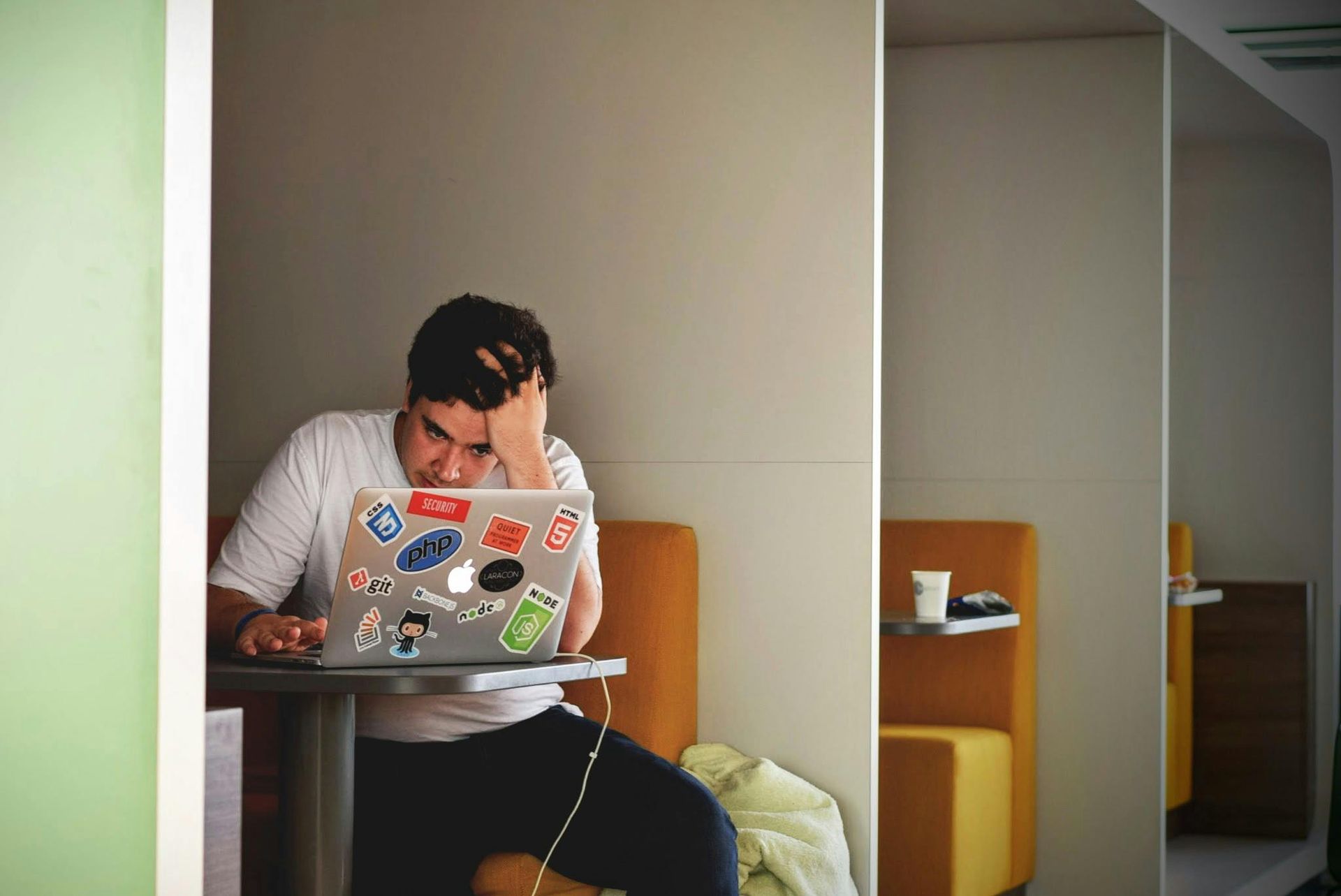

Income Documentation: One of the key requirements for filing Chapter 7 bankruptcy is providing documentation of your income. This includes pay stubs from the past six months, tax returns from the previous two years, and any other sources of income such as rental properties or business income. This information helps determine your eligibility for Chapter 7 bankruptcy and assesses your ability to repay debts.

List of Assets and Property: Another crucial document needed for filing Chapter 7 bankruptcy is a detailed list of all your assets and property. This includes real estate holdings, vehicles, bank accounts, retirement accounts, valuable personal belongings, and any other assets you own. Providing an accurate inventory of your assets allows the court to determine which assets are exempt from liquidation and which may be used to repay creditors.

List of Debts: In addition to listing your assets, you must also provide a comprehensive list of all your debts when filing for Chapter 7 bankruptcy. This includes credit card bills, medical bills, personal loans, mortgage debt, car loans, tax debt, student loans (although usually not dischargeable), and any other outstanding debts. Having a complete list of debts helps ensure that all creditors are included in the bankruptcy proceedings.

Credit Counseling Certificate: Before filing for Chapter 7 bankruptcy in Louisiana, you are required to complete a credit counseling course from an approved agency within six months prior to filing. You must submit a certificate of completion along with your bankruptcy petition as proof that you have fulfilled this requirement. The credit counseling course aims to educate individuals on managing finances and exploring alternatives to bankruptcy.

Bankruptcy Petition and Schedules: The final set of documents required for filing Chapter 7 bankruptcy in Louisiana includes the official bankruptcy petition and schedules. These forms provide detailed information about your financial situation, including income, expenses, assets, liabilities, contracts or leases in effect at the time of filing, and more. Completing these forms accurately is essential to ensure a smooth bankruptcy process.

Filing for Chapter 7 bankruptcy in Louisiana can be complex and involves submitting various documents to support your case. At De Leo Law Firm, LLC we understand how overwhelming this process can be and are here to help guide you through it every step of the way. By providing all necessary documentation accurately and promptly, you can increase your chances of a successful outcome in your Chapter 7 bankruptcy case. Contact us today to schedule a consultation and let us assist you with your bankruptcy needs!