Essential Documents Needed to File Chapter 13 Bankruptcy in Louisiana

Essential Documents Needed to File Chapter 13 Bankruptcy in Louisiana

Filing for Chapter 13 bankruptcy in Louisiana requires careful preparation and a complete set of financial documents. At De Leo Law Firm, LLC, we assist individuals and families in Mandeville with navigating this process efficiently and accurately. Chapter 13 bankruptcy allows debtors to reorganize their debts into a manageable repayment plan, but success depends on meeting the documentation requirements of the U.S. Bankruptcy Court.

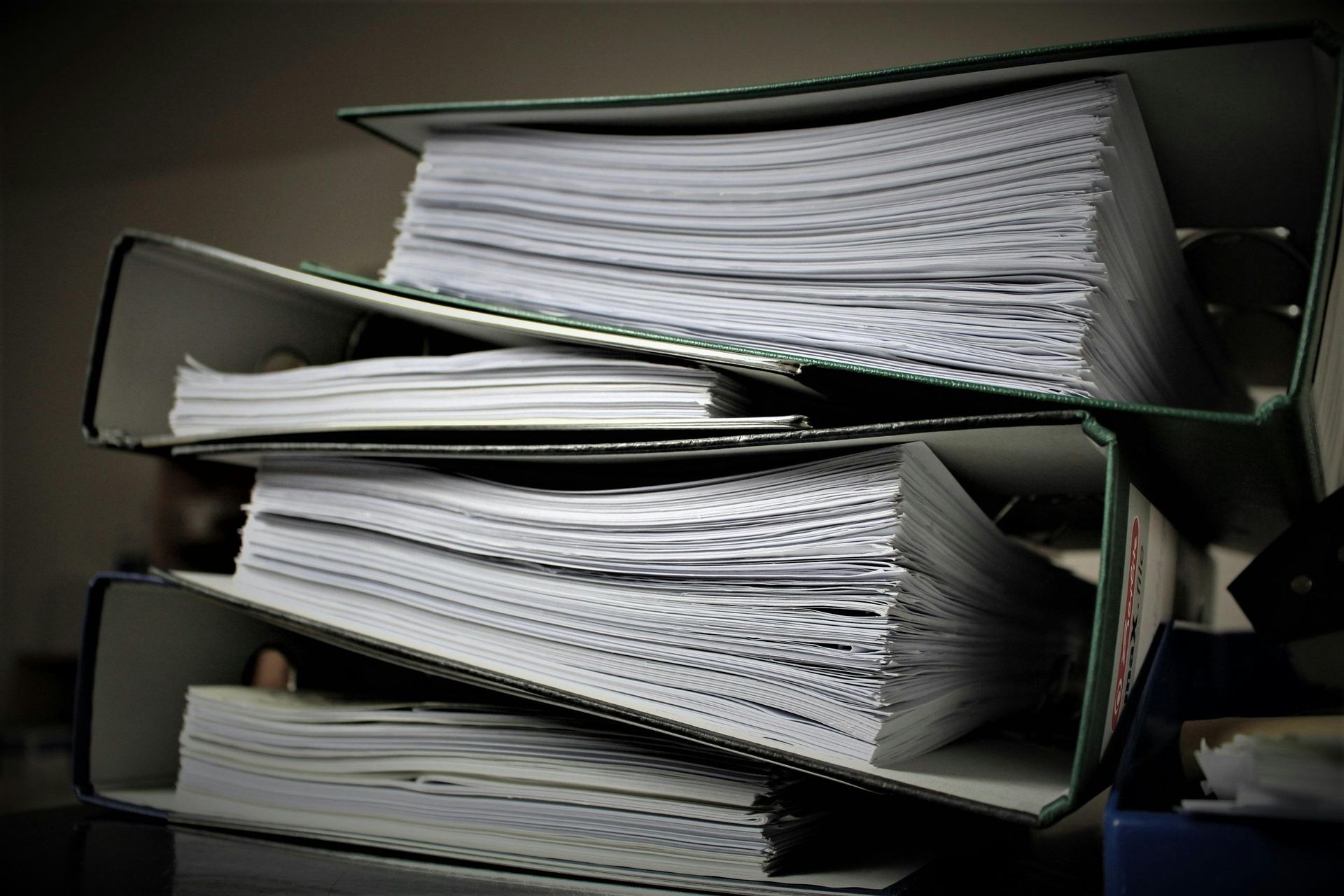

Required Documents for Chapter 13 Bankruptcy

Before you file, be prepared to gather and submit the following:

1. Petition and Schedules

These are the core bankruptcy forms and include:

- Voluntary Petition (Form B101)

- Schedules A/B through J (listing assets, debts, income, and expenses)

- Statement of Financial Affairs

2. Proof of Income

You must show all income sources from the past 60 days, including:

- Pay stubs

- Profit and loss statements (if self-employed)

- Government benefits documentation

- Child support or alimony income

3. Tax Returns

You’ll need to submit copies of:

- Federal and state income tax returns for the past 4 years

- Any unfiled returns must be filed before submitting your bankruptcy case

4. Recent Bank Statements

Bank account records for the last 2–3 months provide a snapshot of your financial activity and are used to confirm your listed income and expenses.

5. List of Creditors and Debts

A detailed list of all your creditors, their contact information, the amounts owed, and the nature of the debt must be provided.

6. List of Assets and Property

You must disclose all real estate, vehicles, personal property, and other assets, even if they are exempt from liquidation under Louisiana bankruptcy law.

7. Credit Counseling Certificate

Before filing, you are required to complete a credit counseling course from an approved provider. A certificate of completion must be submitted with your petition.

8. Chapter 13 Repayment Plan Proposal

This is your proposed plan for repaying your debts over a 3–5 year period. The plan must comply with bankruptcy rules and show how you intend to catch up on secured debts and pay unsecured creditors.

Let De Leo Law Firm, LLC Guide You

Bankruptcy is not just about paperwork—it’s about strategy and accuracy. Missing or incorrect documents can lead to delays or even case dismissal. De Leo Law Firm, LLC is here to help Mandeville residents understand their obligations and confidently move forward with a Chapter 13 case that is properly prepared and filed.