Can I Discharge Tax Debt Through Bankruptcy in Louisiana?

Can I Discharge Tax Debt Through Bankruptcy in Louisiana?

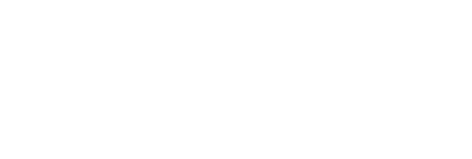

Tax debt can be one of the most stressful financial burdens to face, especially when you’re already struggling to stay afloat. Many Louisiana residents wonder if bankruptcy can help relieve this pressure. The answer is: in some cases, yes. Certain types of tax debt can be discharged through bankruptcy—but only if specific conditions are met.

Understanding How Bankruptcy Affects Tax Debt

Not all tax debts qualify for discharge. The key factors depend on the type of tax, how old it is, and whether you filed your returns on time. Generally, income tax debt is the only type eligible for discharge; payroll and fraud-related taxes cannot be wiped out.

Conditions for Discharging Tax Debt in Bankruptcy

To discharge tax debt in Louisiana, these requirements usually apply:

- The tax return was due at least three years ago.

- You filed the tax return at least two years before filing bankruptcy.

- The IRS assessed the tax at least 240 days before your bankruptcy filing.

- No fraud or willful tax evasion occurred.

If all these conditions are met, your income tax debt may be eligible for discharge under Chapter 7 or Chapter 13 bankruptcy. Chapter 7 can eliminate qualifying debts entirely, while Chapter 13 allows you to repay a portion of your debt through a structured repayment plan, possibly reducing the total amount owed.

Why Legal Guidance Matters

Tax and bankruptcy laws are complex, and one small mistake can prevent your debt from being discharged. Having an attorney guide you through the process can make the difference between full financial relief and continued tax liability.

At De Leo Law Firm, LLC, we can provide legal assistance to the Mandeville public. Our team can help determine whether your tax debt qualifies for discharge and guide you through the steps toward a fresh financial start.